Our Stablecoins

Our Gold-Backed Collateral Stablecoins

Our collateral stablecoins for banks and financial entities are regulatory-approved, independently security audited, and backed by real-world Gold (Au) bullion: EIG Bank Coin (EIGBC) and USD Gold (USDAU)

Driving Digital Asset Collateral

EIG Global Trust is at the forefront of the global digital asset transformation with its revolutionary real-world gold (Au) bullion asset backed stablecoins. The proof of reserves is secured by $5 trillion USD worth of allocated reserved gold (Au) that has been officially recorded with the Federal Reserve System (The Fed). Our stablecoins are regulatory-approved, independently security audited, and “double-backed” by both US Dollars (USD) and Gold (Au) bullion. Introducing our gold-backed stablecoins: EIG Bank Coin and USD Gold:

EIG Bank Coin (EIGBC)

Our audited foundation stablecoin has a high $1 million US Dollar (USD) peg value per coin to support our banking partners. This digital collateral leverages credits lines for project financing and other digital asset products. EIGBC is 100% backed by real-world reserved gold (Au) bullion & registered and verified precious metals.

Launched in 2023, EIGBC has a potential total supply of 91 million digital coins providing able growth room to accommodate the expected enormous growth of digital assets for central and commercial banks & other financial institutions. EIGBC was built on a proprietary blockchain that is intentionally NOT connected to public exchanges.

EIGBC and its blockchain source code was independently audited by blockchain cybersecurity leader Hashlock Pty Ltd.

USD Gold (USDAU)

Our audited complementary stabletoken to EIGBC has a $1,000 (USD) peg value per token. The token is used to support partners for transaction settlement, additional spread leveraging, and indemnification purposes. USDAU is also “double” backed by USD $ and its equivalents + real-world gold (Au) bullion & registered and verifiable precious metals.

Launched in 2025, the stabletoken is built on the BNB Smart blockchain and has a potential total supply of 2.5 billion tokens. USDAU is the mechanism to provide transactional payments (i.e. coupon payments). With the ability to “re-sell” USDAU to clients, it gives partners the ability to earn high returns by leveraging the spreads earned by EIG Global Trust vs payouts to clients.

USDAU blockchain was also independently audited by Hashlock Pty Ltd and passed without issues.

Pivotal Shift Back to Gold-Backed Currency

EIG Global Trust is actively facilitating the pivotal shift back to a Bretton Woods System from fiat currency towards gold-backed digital asset stablecoins. Our turn-key model is aimed to stabilize and enhance the international monetary framework. We provide the much needed gold-backed collateral for the financial community. Our distinguished track record in global banking, financial trading products, project financing, and auditing is further strengthened by the recent completion of rigorous cybersecurity and Proof of Reserves stablecoin audits.

A stablecoin is priced based on the underlying or “backed” asset unlike other cryptocurrencies that are based on no assets with prices solely based on supply and demand (i.e. Bitcoin). Most stablecoins are tied to fiat currency with a peg value of $1 US Dollar (USD). Although the World Economic Forum reported that 2024 stablecoin transactions exceeded $27 trillion USD, or the total value of Visa and Mastercard combined; their impact in the financial sector has been limited by today’s retail stablecoins primarily used as the “middle-man” in trading other cryptocurrencies. With new regulatory framework coming into focus such as the USA Genius Act and European Union’s MiCA, the stablecoin industry is about to explode and EIG Global Trust is at the forefront.

The $5 Trillion Gold Proof of Reserves

EIG Global Trust has secured an initial $5 trillion worth of real-world asset gold backing facilitating transformative digital asset solutions tailored to central banks, commercial banks, private banks, financial institutions, hedge funds, and high-net worth portfolios such as family offices. Our mission is to provide hard asset-backed (gold) digital currency in the form of collateral stablecoins to enhance the leveragability, efficiency, and accountability of the banking community existing financial products and processes.

In December 2024, EIG Global Trust partnered with a Gold Consortium and secured $5,000,000,000,000 ($5 trillion USD) of reserved gold (Au) bullion or a total of 59,061.63 metric tonnes. EIG Global Trust has initially allocated the reserved gold on 95:5 basis to EIGBC and USDGOLD with additional allocations as market demands for USDGOLD.

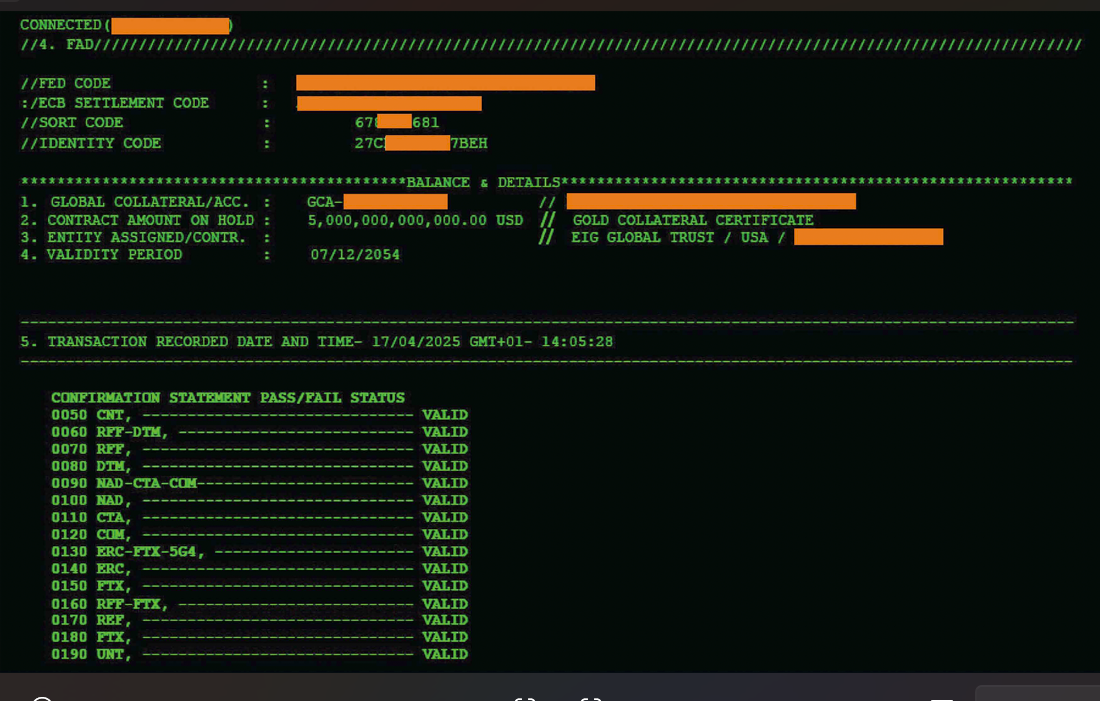

The screenshot exhibit below show $5 trillion Negotiable Gold Certificate of Collateral recorded in a US Federal Reserve account with EIG Global Trust as the “Entity Assigned”.

Gold Certificate of Collateral on Federal Reserve Audit Screen

The Fed is the world’s sole reference and auditing organization of the privately held historical trust holdings of gold reserves. The screenshot that follows shows EIG Global Trust as the Entity Assigned to the Gold (Au). Exhibit A is redacted due to the sensitivity of identity of our partner and bank codes.

Exhibit A. $5 Trillion Negotiable Gold Certificate Recorded on the US Federal Reserve Audit Screen and Assigned to EIG Global Trust for a 30-year period (until 2054)

Grow Your Digital Assets with EIG Global Trust

EIG Global Trust brings truly turn-key digital asset solutions for the banking and projects communities. Our solutions start with gold-backed stablecoins for collateralized credit lines to project financing to full-service management and advisory services throughout. Let us transform your world to a secure digital asset ecosystem by partnering with us today.