How it Works

Our Digital Currency Stablecoin Solutions

This pioneering approach using our EIG Bank Coin (EIGBC) and USD Gold (USDAU) stablecoins as digital collateral is superior to traditional fiat as it streamlines project financing and provides gold-backed digital assets to transform financial instruments, products and trading to highly efficient and secure blockchain transactions.

The Benefits of Digital Asset Collateral

EIG Global Trust is at the forefront of the global digital asset transformation with its revolutionary gold-backed stablecoins. The proof of reserves is secured by $5 trillion USD worth of allocated reserved gold (Au) that has been officially recorded with the Federal Reserve System (The Fed). Our stablecoins are regulatory-approved, independently security audited, and “double-backed” by both US Dollars (USD) and real-world asset Gold (Au) bullion. Introducing our gold-backed stablecoins: EIGBC and USDAU:

Enhanced Collateral for Credit Lines

The transformation of fiat assets to digital currency backed by gold significantly enhances collateral leverage ratios and accountability for credit lines issued for project financing, financial instruments, and Real World Asset (RWA) tokenization. Our blockchain based gold-backed stablecoin solutions deliver superior security, transparent ledger tracking, streamlined settlement and robust audit fraud prevention.

EIG Global Trust further strengthens the offering by providing the much needed project management ensuring partners share in the revenue streams from the project financed. Unlike today’s project financing that has numerous accountability issues, we provide a responsible turn-key approach that streamlines and tracks project funding, driving investment into critical infrastructure and economic development initiatives for partners.

Stablecoin “Wrapping” of Financial Instruments

EIG Global Trust gold-backed stablecoins can be added to existing fiat based financial instruments or newly created ones creating a “wrapped digital asset”. This “tokenization” of the asset creates a digital asset that can leverage blockchain attributes providing huge advantages including ledger tracking for transparency, offer increased leverage ratios, and higher returns since our stablecoins are gold-backed. This solution is similar to Real World Asset (RWA) tokenization involving wrapping existing property assets such as real estate into trackable and a tradable digital footprint or token.

Balance Sheet Enhancement & Indemnification

EIG Global Trust stablecoins are designed to provide long-term digital asset solutions for partners offering high returns during the holding process. When used for credit lines the typical initial period is 5-years with possible rolls and extensions. In turn, we offer favorable interest/coupon rates of return to partners for their commitment. This long-term approach provides the partners benefits over traditional fiat.

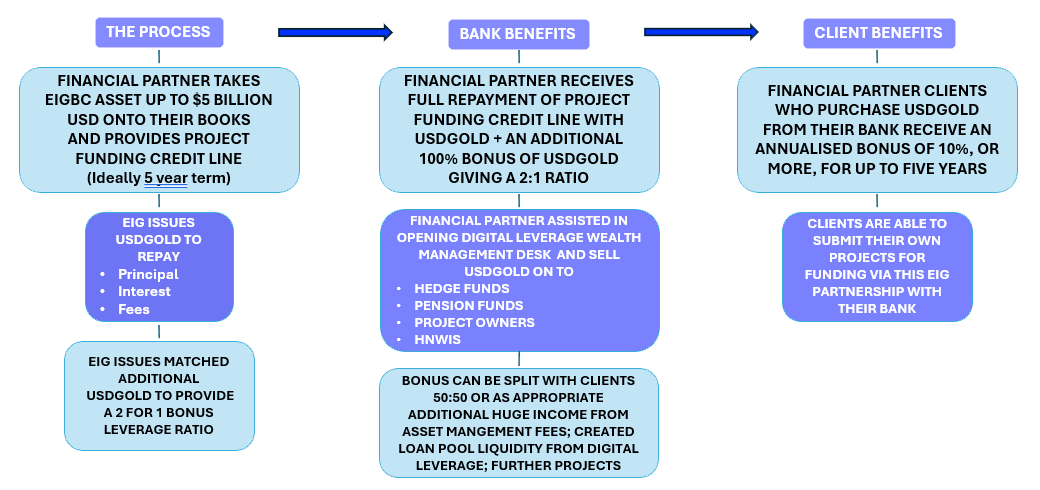

Currently, EIG Global Trust is offering new partners a 2 for 1 match solution where in addition to issuing EIGBC to partners without any purchase requirement or debt (booked as an asset on the balance sheet), we will “match” that amount with USDAU issuance further enhancing the balance sheet and leverage ratios. We are able to commit to this industry leading mechanism because of our unique gold-backed stablecoins and taking a long-term approach. Partner banks benefits include increased project returns since more credit lines can be established and creates a new digital asset for their clients who can invest their fiat balances into the additional USDAU provided by EIG Global Trust. Note: EIGBC cannot be resold or transferred to clients as its primary purpose is to provide digital asset collateral. We do allow EIGBC to be transferred or split into multiple wallets within the partners domain.

Process Flow for 2 for 1 Offer Partner Bank and their Client Product Benefits

Earn Returns on Favorable Spreads with Clients

EIG Global Trust is offering new partners a 20% annual return in exchange for holding both EIGBC and USDAU stablecoins for a 5-year period. In addition, the USDAU can be “re-packaged” as digital asset product for our partners offering their existing clients the ability to purchase or invest in USDAU stablecoins (transfer to client’s wallets or held in the partners custodial account). For example, the partner can offer their clients an 8% annual return, keeping the difference or earning a 12% annual return for themselves.

Central Bank Digital Currency (CBDC)

Our gold-backed stablecoins can also provide the mechanism and stabilization of national digital currency or CDBC. Similar to using EIGBC as collateral for credit lines, the digital collateral can be used to back a country’s initiative to launch a CBDC pegged to their fiat currency. Our solution allows country partners to book EIGBC on their balance sheets as the asset vs adding new debt or simply minting new “unbacked” stablecoins into their marketplaces. EIG Global Trust also offer a turn-key solution to build new gold-backed stablecoins and end-to-end management and rollout to support the country’s CBDC initiatives thus providing a “one-stop-shop”.

Also in development is a fast, scalable, and secure platform to power digital currency retail ecosystems. The platform will leverage the company’s gold backed stablecoin model to provide “last mile” solutions leveraging the CBDC enabling wallet transfers and transactions, a true end-to-end EIG Global Trust digital infrastructure. Once integrated into the country’s CBDC and retail marketplace, stablecoins deliver superior security and streamlined settlement for critical cross-border transactions that many countries suffer from due to requirement to “purchase” more convertible fiat currencies like the USD or Euro.

Grow Your Digital Assets with EIG Global Trust

EIG Global Trust brings truly turn-key digital asset solutions for the banking and projects communities. Our solutions start with gold-backed stablecoins for collateralized credit lines to project financing to full-service management and advisory services throughout. Let us transform your world to a secure digital asset ecosystem by partnering with us today.